GNB REAL ESTATE

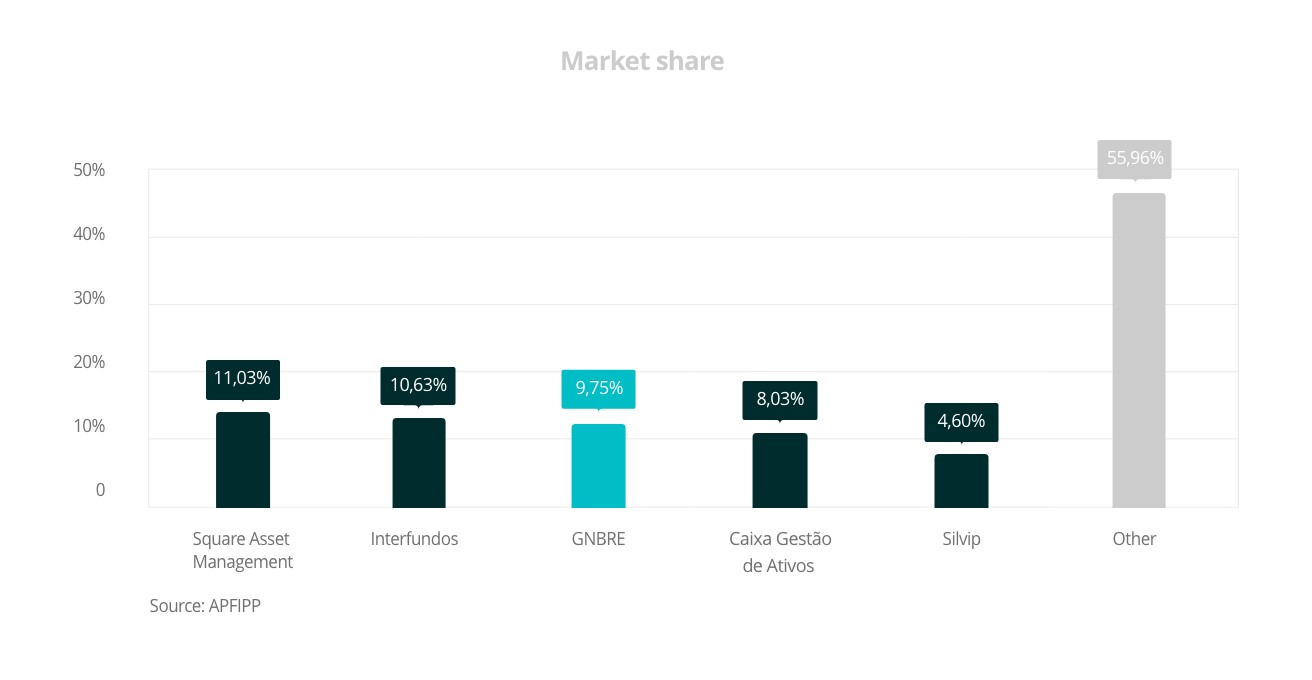

Uma das maiores e mais importantes gestoras de ativos imobiliários em Portugal.

01.

Integrados numa instituição de gestão de activos reconhecida e premiada (uma das primeiras instituições em Portugal).

02.

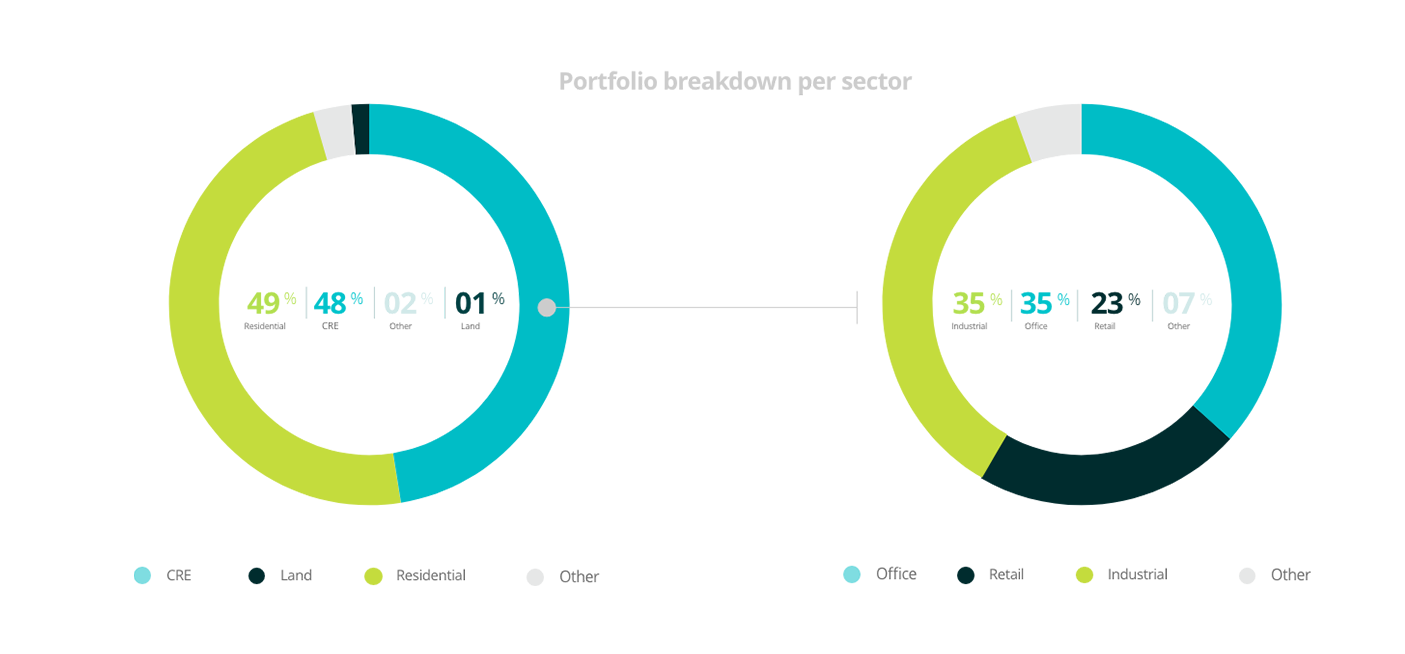

Consistentemente entre as maiores e mais relevantes sociedades gestoras – com um portfolio de ativos sob gestão superior a 1.000 milhões de euros.

03.

Equipa altamente qualificada e experiente, com um vasto e alargado conhecimento do mercado e competência na gestão de ativos.

04.

Mais de 20 fundos em diferentes classes de ativos e perfis de risco.

Visão Geral Jan 2019

Operações Realizadas, Operações em Curso e Operações de Rendimento

Alguns exemplos:

Reabilitação do Edifício Monsanto

Eurostars Museum

Palácio Condes de Murça

Edifício Rosa Araújo 19

Vencedor do Prémio Valmor

Edifício Marquês de Abrantes

Contador Mor

Prémio Nacional de Reabilitação Urbana em 2006 - Melhor Intervenção Residencial

Reabilitação Campera

Processos de Vendas

Para mais informações, por favor contacte-nos.

Equipa

Volkert Reig Schmidt

Presidente do Conselho de Administração (CEO)

Presidente do Comité de Investimentos Imobiliários

Presidente do Comité de Investimentos Imobiliários

Ana Paula Marcelo

Administradora Financeira (CFO)

Nelson Martins

Administrador de Operações (COO)

Bernardo d’Aguiar Frazão

Director Coordenador do Departamento de Gestão de Fundos e Novo Negócio

Membro do Comité de Investimentos Imobiliários

Membro do Comité de Investimentos Imobiliários

Clara Silva

Directora Coordenadora do Departamento de Activos Estratégicos

Membro do Comité de Investimentos Imobiliários

Membro do Comité de Investimentos Imobiliários

Bruno Oliveira

Head of RE Development

Member of the Investment Committee

Member of the Investment Committee

Margarida Rei

Directora do Departamento de Suporte Financeiro e Avaliações

Vitor Oliveira

Diretor do Gabinete de Investimentos Imobiliários

Jennifer Spínola Abreu

Diretora do Departamento Jurídico

Volkert Reig Schmidt

Volkert Reig Schmidt, Spanish citizen, has joined Novo Banco, in Lisbon, as a Managing Director in 2017, after the bank’s acquisition by several of the Lone Star Funds, and in 2019 as the Chief Executive Officer of GNB’s Real Estate Board of Directors in charge of managing a EUR 2.7 billion REO book. Mr. Reig Schmidt is also the Chair of the Investment Committee.

Volkert has over twenty-years of international experience in M&A, private equity and real estate. Prior to joining Novo Banco, Mr. Reig Schmidt served as a Managing Director for Hudson Advisors, where he was responsible for executing and structuring the acquisition, management and disposal of residential and commercial RE backed NPL portfolios. In that capacity, since 2012 he has managed the sale of over EUR 3 billion worth of real estate assets and has acted as the lead negotiator in the friendly repossession of over EUR 1.5 billion of NPLs.

Prior to his exposure to the NPL world, Volkert practiced law in Madrid, Hamburg, Brussels and in New York advising in cross border M&A transactions in firms such as White & Case, Winston & Strawn and Gomez-Acebo & Pombo. Mr. Reig Schmidt has a Master in Law from the Universidad San Pablo CEU and is admitted to practice in the Madrid Bar Association. Volkert is fluent in Spanish, German and English and has a basic knowledge of French and Portuguese.

Volkert has over twenty-years of international experience in M&A, private equity and real estate. Prior to joining Novo Banco, Mr. Reig Schmidt served as a Managing Director for Hudson Advisors, where he was responsible for executing and structuring the acquisition, management and disposal of residential and commercial RE backed NPL portfolios. In that capacity, since 2012 he has managed the sale of over EUR 3 billion worth of real estate assets and has acted as the lead negotiator in the friendly repossession of over EUR 1.5 billion of NPLs.

Prior to his exposure to the NPL world, Volkert practiced law in Madrid, Hamburg, Brussels and in New York advising in cross border M&A transactions in firms such as White & Case, Winston & Strawn and Gomez-Acebo & Pombo. Mr. Reig Schmidt has a Master in Law from the Universidad San Pablo CEU and is admitted to practice in the Madrid Bar Association. Volkert is fluent in Spanish, German and English and has a basic knowledge of French and Portuguese.

Ana Paula Marcelo

Ana Paula Marcelo, Portuguese national, has joined GNB Real Estate Board of Directors as the Chief Financial Officer in January 2019.

Mrs. Marcelo has over twenty-eight years of financial experience in the banking sector at BES/Novo Banco Group and eight years as CFO in different group companies. Since 2017, Mrs. Marcelo is a member of the Supervisory Board of a Venture Capital Firm. Mrs. Marcelo holds a degree in Economics and a Master’s in Monetary and Financial Economics both from University of Lisboa – ISEG. She has advanced training in Recovering and Restructuring Companies from Católica-Lisbon School of Business and Economics, in Taxation from ISCTE Business School and has attended a course for Certified Auditors from the Certified Auditor’s Association in Lisbon. She is also permanent member of the Economists Bar and of the Portuguese Certified Auditor’s Association.

Mrs. Marcelo has over twenty-eight years of financial experience in the banking sector at BES/Novo Banco Group and eight years as CFO in different group companies. Since 2017, Mrs. Marcelo is a member of the Supervisory Board of a Venture Capital Firm. Mrs. Marcelo holds a degree in Economics and a Master’s in Monetary and Financial Economics both from University of Lisboa – ISEG. She has advanced training in Recovering and Restructuring Companies from Católica-Lisbon School of Business and Economics, in Taxation from ISCTE Business School and has attended a course for Certified Auditors from the Certified Auditor’s Association in Lisbon. She is also permanent member of the Economists Bar and of the Portuguese Certified Auditor’s Association.

Nelson Martins

Nelson Marques Martins, Portuguese citizen, has joined GNB Real Estate Board of Directors as Chief Operations Officer in January 2019.

Mr. Nelson Martins has over twenty-five years of experience in the banking sector, always within the BES/Novo Banco Group spectrum. Mr. Martins areas of expertize range from organization and quality, business growth, implementation of new IT systems, creation of new business units and process reengineering. Between 2004 and 2018, Mr. Nelson Martins was Head of the Group’s Internal Audit department, covering Portugal and some international business units. Additionally, during ten-years, served as vice-president of the Portuguese Institute of Internal Audit (IIA Portugal), promoting discussion forums on the financial sector.

Mr. Nelson Martins holds a degree in Economics and an executive program in Advanced Executive Management both from University of Lisboa – ISEG and also an executive program in Banking and Corporate Governance from Nova SBE.

Mr. Nelson Martins has over twenty-five years of experience in the banking sector, always within the BES/Novo Banco Group spectrum. Mr. Martins areas of expertize range from organization and quality, business growth, implementation of new IT systems, creation of new business units and process reengineering. Between 2004 and 2018, Mr. Nelson Martins was Head of the Group’s Internal Audit department, covering Portugal and some international business units. Additionally, during ten-years, served as vice-president of the Portuguese Institute of Internal Audit (IIA Portugal), promoting discussion forums on the financial sector.

Mr. Nelson Martins holds a degree in Economics and an executive program in Advanced Executive Management both from University of Lisboa – ISEG and also an executive program in Banking and Corporate Governance from Nova SBE.

Bernardo d’Aguiar Frazão

Bernardo d’Aguiar Frazão, Portuguese citizen, has joined GNB Real Estate in 2018. He serves as Head of GNB Real Estate Funds Management and New Business and sits on the Real Estate Investment Committee.

Prior to this position, Mr. Frazão spent one year at Novo Banco as an Advisor to the General Supervisory Board. Between 2013 and 2017, Mr. Frazão worked as Senior Economic Advisor at the U.S. Embassy in Lisbon, where he was in charge of research and analysis across the main economic and financial issues. He was also the primary liaison with the Portuguese Authorities, including the Prime-Minister Office, Finance Ministry, Bank of Portugal and the Portuguese Debt Management Agency (IGCP).

Before this, Mr. d’Aguiar Frazão spent almost seven years at IGCP dealing room working as a Senior Trader and eighteen months as a FX Sales/Trader at Barclays dealing room both in Lisbon. He started his career as a cost reduction consultant at CRA Executive Consultants Portugal. Mr. Frazão holds a BSc (Hons) in Economics (University of Lisbon - ISEG) and a post-graduation in Finance (Nova SBE). He has also attended several executive programs: including Fixed Income at Católica-Lisbon School of Business and Economics, Leadership course at Foreign Service Institute (FSI) in Frankfurt, an Economic course at FSI in Washington DC/Arlington and Interest Rates Derivatives Intensive Course at Goldman Sachs in London. He received two Mission Honor Awards and the first Local Employee of the Quarter Award during his tenure at the U.S. Embassy.

Prior to this position, Mr. Frazão spent one year at Novo Banco as an Advisor to the General Supervisory Board. Between 2013 and 2017, Mr. Frazão worked as Senior Economic Advisor at the U.S. Embassy in Lisbon, where he was in charge of research and analysis across the main economic and financial issues. He was also the primary liaison with the Portuguese Authorities, including the Prime-Minister Office, Finance Ministry, Bank of Portugal and the Portuguese Debt Management Agency (IGCP).

Before this, Mr. d’Aguiar Frazão spent almost seven years at IGCP dealing room working as a Senior Trader and eighteen months as a FX Sales/Trader at Barclays dealing room both in Lisbon. He started his career as a cost reduction consultant at CRA Executive Consultants Portugal. Mr. Frazão holds a BSc (Hons) in Economics (University of Lisbon - ISEG) and a post-graduation in Finance (Nova SBE). He has also attended several executive programs: including Fixed Income at Católica-Lisbon School of Business and Economics, Leadership course at Foreign Service Institute (FSI) in Frankfurt, an Economic course at FSI in Washington DC/Arlington and Interest Rates Derivatives Intensive Course at Goldman Sachs in London. He received two Mission Honor Awards and the first Local Employee of the Quarter Award during his tenure at the U.S. Embassy.

Clara Silva

Clara Silva, British/Portuguese national, has joined GNB Real Estate as Head of the Strategic Assets in 2018, coming from Hudson Advisors. She sits on the Real Estate Investment Committee. Before this position, Ms. Silva was a Board Member and Head of the Commercial Real Estate & Residential Divison at PRAGMA – Management (which resulted from Chamartín Imobiliária MBO). She was responsible for the accounts of Lone Star and Merlin Properties in their investments in Portugal. Ms. Silva started to work in the Real Estate sector in 2006, at Amorim Imobiliária, the leading Portuguese commercial real estate developer and owner at the time. Their portfolio included some of the most known business centers in Portugal, including Torres de Lisboa, Centro Empresarial Praça de Espanha and Sintra Business Park, as well as the first student housing concepts.

Between 1999 and 2006, Ms. Silva worked at PwC’s Audit Department, providing services to several PSI-20 and international companies, such as Portucel, Xerox Portugal and Walt Disney Company. Clara holds a Business Management degree and a post-graduation in Fiscal Management, both from ISCTE Business School.

Between 1999 and 2006, Ms. Silva worked at PwC’s Audit Department, providing services to several PSI-20 and international companies, such as Portucel, Xerox Portugal and Walt Disney Company. Clara holds a Business Management degree and a post-graduation in Fiscal Management, both from ISCTE Business School.

Bruno Oliveira

Bruno Oliveira, Portuguese national, has joined GNB Real Estate as Development Project Manager in 2018, coming from Hudson Advisors. He sits on the Real Estate Investment Committee. Mr. Oliveira has over fifteen-years’ experience in project management and business development across several sectors, including offices, retail, industrial, residential and hospitality. Before this, Mr. Oliveira was Senior Project Manager at Cushman&Wakefield, where he led various fit-out projects for renowned companies.

Between 2010 and 2015, Mr. Oliveira was Head of PMO at COBA Group, being directly responsible for resource allocation and budget forecasting for major projects (High Speed Railway, Dams, Highways, Tunnels and Airports) and deputy for National and International Business Direction. Prior to this, he spent four years at SONAE CAPITAL as Development Project Manager at Troiaresort. Mr. Oliveira holds a degree in Civil Engineering and completed several executive programs, including Advanced Program in Project Management and Evaluation (Católica-Lisbon) and General Management Program (AESE-IESE).

Between 2010 and 2015, Mr. Oliveira was Head of PMO at COBA Group, being directly responsible for resource allocation and budget forecasting for major projects (High Speed Railway, Dams, Highways, Tunnels and Airports) and deputy for National and International Business Direction. Prior to this, he spent four years at SONAE CAPITAL as Development Project Manager at Troiaresort. Mr. Oliveira holds a degree in Civil Engineering and completed several executive programs, including Advanced Program in Project Management and Evaluation (Católica-Lisbon) and General Management Program (AESE-IESE).

Margarida Rei

Margarida Rei, Portuguese citizen, has joined ESAF/GNB Real Estate in 2000. At the moment, she is the Head of Financial Support. Prior to this position, Ms. Rei worked in financial audit at PricewaterhouseCoopers (PwC Portugal), where she began her career and worked in several areas such as: pharmaceutical, agricultural and industrial market, investment funds and real estate. Margarida Rei holds a Business Management degree (University of Lisbon - ISEG) and two post-graduations: in Management (ISCTE Business School) and in Tax (Catholic University-Faculty of Law).

Vitor Oliveira

Vítor Oliveira, Portuguese citizen, has joined GNB Real Estate as Head of Investment Management in 2018, coming from Hudson Advisors. He has been responsible for structuring and executing Novo Banco’s real estate divestment strategy and for leading the investment strategy of the funds managed by GNB RE.

Mr. Oliveira has over five years of experience in the real estate sector, managing transactions in Portugal and Spain across most asset classes, namely residential, office, and hospitality with a combined value of over €1.5bn. Prior to his current position, he worked in the Capital Markets team at CBRE, advising on some of the largest transactions in Portugal (sell side and buy side roles), and previously in the M&A team at Deloitte.

Mr. Oliveira holds a Master in Finance from Católica - Lisbon.

Mr. Oliveira has over five years of experience in the real estate sector, managing transactions in Portugal and Spain across most asset classes, namely residential, office, and hospitality with a combined value of over €1.5bn. Prior to his current position, he worked in the Capital Markets team at CBRE, advising on some of the largest transactions in Portugal (sell side and buy side roles), and previously in the M&A team at Deloitte.

Mr. Oliveira holds a Master in Finance from Católica - Lisbon.

Jennifer Spínola Abreu

Contacts

Contact Us

Rua Castilho 26, 9º

1250-069 Lisboa

Portugal

Tel: (351) 21 381 08 00

Email: contact@gnbre.pt

1250-069 Lisboa

Portugal

Tel: (351) 21 381 08 00

Email: contact@gnbre.pt

Companies

GNB Gestão de Ativos

GNB Fundos Mobiliários

GNB Fundos de Pensões

GNB Gestão de Patrimónios

GNB International Management

GNBGA 2019 all right reserved